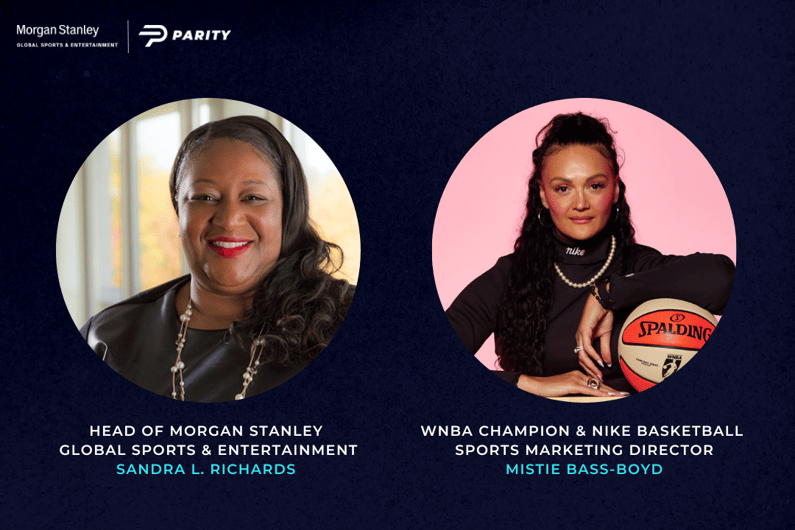

We spoke with Head of Morgan Stanley Global Sports & Entertainment, Sandra L. Richards, and retired WNBA champion / current Nike Marketing Director Mistie Bass-Boyd on not just why financial literacy is so important for athletes - collegiate and professional - but also how to change your mindset to become the "CEO of you."

Read excerpts from their inspirational conversation below, and click here to watch the full interview.

Get everyone on the same page.

Tell us more about why Morgan Stanley chooses to not only educate athletes but also their coaches, team staff, and family members.

Tell us more about why Morgan Stanley chooses to not only educate athletes, but also their coaches, staff, and family members.

Sandra: When you think about everyone around an athlete or entertainer — from family members to coaches, to agents — it's important for everyone in their circle to have some level of the same information, from a financial education standpoint, to keep them on the right financial path and on the same page.

As we're offering these young people the right guidance and shepherding them through their careers, these young people should also be able to lean on trusted individuals who understand and support their goals.

No one knows your heart more than your parent(s) or guardian(s) who have played (and continue to have) an important role in your life, so having these integral people involved in important conversations — and collectively understanding what might happen along the way — is important. Some people need the guidance peripherally, and some might need it directly. But no matter what, I think everybody needs to have that conversation.

Mistie: Right, there is so much knowledge that the majority of the time, those athletes don't know and that the people around them don't know. So, when an athlete comes into a certain amount of money [for the first time], they may be coming from a spending background because that's all they've ever known.

What you're talking about, Sandra, is that it's not just that we need to educate the athlete, the celebrity, or the entertainer.

We actually have to educate everybody. Because people need to recognize that there's only so much money that you can manage.

And once you really start to manage all that extra stuff that we see on social media and we see on television... you do all that stuff, and you won't have any money.

You don't recognize that you actually shouldn't spend like that. You should be spending a certain percentage, and without that guidance for the entire team, the entire team's going to fail.

Sandra: Exactly. And it's so interesting you say that because you have the individuals who are definitely the spenders, but then you also have those who are more cautious with their money and not as comfortable spending a lot — so much so that they may leave a large portion of their money sitting under the ‘proverbial mattress’ or idly, not putting it to work. Now look, I understand that, too. One might be fearful of having this hard-earned money all of a sudden vanish. So, there are two sides to that equation, which is why we must continually hold forums that emphasize the importance of encouraging these candid and critical conversations about money and financial education.

You also need to think about things like, how were they brought up culturally and what was their relationship with money? What (if any) conversations about money have they been exposed to during their upbringing? What was their knowledge of money? (As a financial educator, specialist, coach, and/or advisor) you need to be able to meet people where they are to be most effective.

Recognize NIL deals as an opportunity to establish healthy financial habits

What are your thoughts on college athletes finally making money from their name, image, and likeness (NIL)? What do these young athletes need to know?

Mistie: Listen, let me tell you, every time I see these NIL deals... I just think back to the time, like wow, college would've been so different for me in such a positive way.

We as athletes — and even before me — were always taught that our education was what we were being paid to compete at the highest level. I knew that getting my diploma from Duke University was going to help me in my future, but I also struggled. Yes, they paid for food, but they didn't pay for gas, they didn't pay for the clothes that I was going to wear, and things like that.

Credit: Duke University

We were struggling athletes, and yet we were making millions of dollars for our university. I can only imagine what that's been like on the men's scale.

And so when the NIL deal came through, it made me feel good. Some of the power was finally going to us athletes.

I mean, if you think about it, let's say you play for four years. Maybe you were a football player who didn't go pro. Twenty years down the road, you may need a hip replacement, a knee replacement, or something as a result of your college athletic career... and your school doesn't have to come and help. There's no accountability for us giving our services beyond saying, oh, we just gave you a college scholarship.

I'm excited for collegiate athletes to finally claim [what should have already been theirs]. I do worry, at the same time, because what we're talking about, in terms of [managing] finances, is that's something a lot of us weren't raised to know what to do.

If you're not taught what to do, there are two things that will happen. You're either going to save it all and not do anything with it or, you're going to spend it all and not have anything.

I think this is also the responsibility of our universities and our colleges. They give us media training, how to show up in the media, what to say, what to stay away from. They should also be teaching us how to consider what finances look like.

Sandra: I'm equally excited too, Mistie. And the interesting thing is, it's so much better when the conversation can come from someone like you, someone who actually lived it and can draw on those shared, lived experiences.

It's important for every brand at every level to understand the deals that they're offering these collegiate athletes, and the potential impact that they are having, and to take some level of responsibility and accountability for what this may entail.

While it's up to the athletes to absorb all of this information, I still think it's our job to ensure that we're having these conversations to guide college and/or young athletes.

(L-R) Taylor Rooks, Turner Sports, Broadcaster; Amy Rodriguez, USC Women’s Soccer, Assistant Coach; Sandra L. Richards, Morgan Stanley, Managing Director/Head of Global Sports & Entertainment; Anna Paglia, Invesco, Global Head of ETFs And Indexed Strategies; Emily Cole, Duke Track & Field, Student-Athlete. Credit: 2022 INFLCR NIL Summit

I want to reiterate the importance of this, of why it should matter to all of us that college athletes have the right knowledge, information, tools, and resources to successfully navigate those four or five years: they're going to be our future leaders, executives, and trailblazers. And I don't want to just throw around this cliche, but it's true.

Think about it: If they don't go on to compete at the professional level in their respective sport, then they are transitioning to the phases of being our next entrepreneurs, our next wave of people entering the workforce. You want a group of individuals who will emerge into the professional workforce or “real world”, so to speak; feeling whole, centered, and fulfilled… equipped with the confidence and foundational knowledge, tools, and resources to be successful at whatever it is that they choose to do.

Be the CEO of your personal brand

Mistie, how important was financial literacy for you during your professional playing days?

Mistie: I always feel like money was one of those taboo things you didn't talk about. My dad forced me to get a paper route when I was young and, try doing that in Wisconsin in the dead of winter, it was not a wonderful experience. When I got to high school, he made me get a job again and I worked at Sears.

It was more about me having extra spending money, though, rather than understanding the value of savings and budgeting.

It wasn't until I got to the WNBA that I was like, what? Now I'm living on my own, I have to get a place to stay, I need a car, all these things.

Credit: High Hopes Hoops

I recognized quickly that money goes just as fast as it comes. And I say this in all transparency, it took me a long time to recognize that because I thought: The checks are going to come, I'm going to keep playing, I'm going to be fine, I'm going to keep taking these trips, I'm living my best life.

You get closer and closer to retirement and you're like, uh-oh, I don't think I've been doing the right thing here.

I will say this, though. The 401K program probably saved me. Didn't even think about that money when I signed up for the program.

And then it became, oh, I'm going to invest with this women's company. And small little things for me that made me feel more confident in the decisions that I was making.

I've definitely evolved in my financial literacy in what it takes to really consider your future, but also still do things that make you feel like you are treating yourself in the moment.

Sandra: When we conduct our financial education sessions, there's a part that we talk about, which is critical to the development and mindsets of these (mostly young) individuals that we work with: being the CEO of you – and the need for them to think of themselves as a business.

So yes, while you're out there playing on the court or on the grass or turf or whatever surface you're competing on, that's one thing, but now you have this other side of the business that you need to think about.

It’s a matter of reshaping your mindset — and relationship with money. How will you continue to invest in yourself to grow?

If you think of yourself as a business, you start to approach life in a whole different way.

I love seeing what the WNBA players are doing today. Many of them are entrepreneurs. I know that some own or are invested in businesses from tea companies, food trucks, and all sorts of other ventures. That speaks to them (WNBA players) being a business of their own, being CEOs of themselves and their business endeavors They're handling business on the court but also handling business off the court — in their personal lives and in their financial lives. And those are the examples that these young (college) athletes need to see… but how do you manage it all? Because that's a lot to put on young people. It's a lot.

I think that's why it's important for us — as adults who are shepherds, supporters, and experts — to be there for them to have these conversations and create safe spaces for these young athletes to say, "I don't know what I don't know, so can you please help me?"

Build financial muscle memory

What is something you wish that women athletes, in particular, knew about money management?

Mistie: I'd say to anyone that no amount is too small to get started with investing and savings. I'd also encourage them to establish healthy boundaries around their money habits and lastly, to be consistent. I feel like if you can manage finances when things are strapped, and you can figure out how to invest or save small, it'll add up over time.

It's all about building. The same way that you have to build muscle memory on the court, or on the pitch, is the same way that you have to build muscle memory with saving, with your spending habits, with being able to say "no."

And saying no could be something as simple as, "No, I'm not going out to dinner with you guys tonight. I've got to work on my CEO business." You have to exercise saying that because sometimes it's really hard.

For example, someone may ask if they can borrow $100 because they know you have it. Well, I think that's also a part of the learning, understanding you should never loan money you're not willing to not get back.

Walk into it thinking, if the average time span of an athlete is four to five years, figure out whatever money you're going to make for those four to five years. If you extend it, great, you are out here doing your thing. But if not, figure out how you can take that income and stretch it and invest it where more is coming in, while you can figure out what that second career looks like.

Because at the end of the day, women have to have a second career. We will retire, and more than likely, we're going to have to start a new profession.

So strike while the iron's hot, but also prepare for what that future looks like when you will have a transition period into whatever your second phase is.

Ask yourself: Where do you want to be in 5 or 10 years?

Sandra: For me, I wish that someone had asked me some of those heavy questions while I was growing up. Now I don't know if I would've received them well when I was 17 (years old) [laughs], but questions like: What are you playing for? What is your why? How do you want things to look for your future?

I heard a coach speak recently about how he talks to his players and asks as he's recruiting them, "Where do you want to go?"

Some may respond, "I want to be in the NFL." He'll say, "Okay, we got to make sure that all the things that you do now are leading you that way. Whether it's from practicing, showing up — how you show up on and off the field — your media presence, social media presence, everything... everything has to be about getting you there.

It's almost like somebody saying to you when you were 17, 16, or even younger, create your vision board. What do you envision for yourself?

I think that if anything, it's not even about the financial piece. It's about a mental shift that comes when you know what you're intentionally planning.

Then all things like the saying ‘no’ [to certain things], you know it's not getting you to where you need to go, so you can't do it. And you'll be comfortable with that. You won't feel guilty because there's a greater purpose that you're working toward.

I think that that's the important conversation because then everything else will fall into place.

Seek communities that will amplify your voice

Mistie, how has working with Parity helped you navigate post-athletic retirement and supported your financial growth?

Mistie: Parity might not have been around when I played, but it has been monumental in the shift that I had to go through to become a professional in the corporate world.

I went through the career coaching program about two years ago. I had only been in my current role for about a year and was still struggling with the transition from being an athlete and having that kind of schedule to adjusting to what I do now.

But to have that coaching, and to have the opportunity to still leverage the brand that I had created on my social media outlets... to have the opportunity and to still feel seen after I walked away? I mean, I can honestly say no other company has done that. No one has asked me, "How can we help you?" Because it was always the opposite. It was always like, "What can you do for me?" Well, I need help right now. Parity was there.

Credit: Mistie Bass

That little subset of income on the side, it's everything. I still feel connected to my community. I still feel like I'm needed or I'm wanted, or that my experiences mattered. And Parity is giving me the ability to show up in different spaces, whether it be a CBD company, or talking about financial literacy.

I'm more than an athlete and with all of my experiences, I want to be able to share those lessons with others to help them on their journeys.

I want to be a stepping stone for those athletes, to give them advice and give them guidance, like Parity has done for me. So while I give, I'm receiving at the same time.

Sandra: That was a beautiful message. And for us at Morgan Stanley, our mission was and remains aligned with Parity’s — to empower our athlete community. So our support of Parity and the work they’re doing was a natural fit that made sense for us to partner. I think it's exactly what you just said Mistie, "My experiences mattered," and amplifying this message as you find your own voice along your journey is imperative and a process we aim to foster for many more athletes we come across.

Additionally, working with Parity on the "Practice Makes Perfect" campaign was about jointly telling those stories about financial challenges and financial wins, and the things that athletes learn from their fellow athletes and even themselves.

Because we know, as I said earlier, people learn from those who lived these shared experiences and who are now sitting in the seats that the upcoming generation aspires to reach. It’s all about paying it forward.

Consider your legacy

What kinds of conversations are happening around creating generational wealth?

Sandra: I think everyone is thinking about it. What do I want my legacy to be, and how do I pass on what I've built to continue for the next generation of my family and those that I care about?

This goes beyond monetary wealth. I need to make sure I pave the way for that to happen. That there is not a struggle that I may have had or that my parents had to get me there, ever experienced again. To have the ability to say: “I did this”. And as this athlete or entertainer, I can be a true role model and example and teacher for many others to look up to me or aspire to reach the level I’ve reached. So, building that generational wealth is definitely the conversation, but it's more about, how do you carry on the legacy overall, beyond the mere dollar? Jay-Z has the best song: "Legacy, legacy, legacy."

Mistie: I mean what you're talking about is currently where I am in the midst of.

I think about my dad doing what he did as a singer and performer, and then me being able to do what I did following my own passions, and then obviously the continuation of that legacy with my two children.

It's not just about finances; it's about how does our entire family level up, break habits of the past that did not serve us as a family, recognize those mistakes, and do better for our future.

My husband and I were just talking about it this morning. How can we give our children all the armor that they need within this home to make it in the world?

We want to love them with all the education and opportunities so that they can go out into this world, take a couple of hits on the chin and still be okay. And the financial literacy piece of that is teaching them now.

Teaching them early so that way they have the full armor of what life is going to encompass, and put them out into the world as strong Black men who know what to do, how to act, and how to make it in this world. And that would be my husband and I's legacy, how they go into the world.

.jpeg?width=1080&height=812&name=repost-mistiebass8-Ce_WPyHr1u-%20(1).jpeg)

L-R Mistie's husband Shane and sons Kashel and Braven. Credit: Mistie Bass-Boyd (Instagram)

If they make it in sports, listen, we're going to be right there just like LeBron and Savannah... But I know that their bag is going to be full of more than just athletic talent. They'll be packed with a power punch of other skill sets that they've learned from infancy. And that's the thing that I think when we look at those athletes that are looking at their next generation, they feel confident because they've done the same thing.

Sandra: Exactly. We are in a position to open doors for the next generation and to keep the kicker down so the door doesn't close. And telling them that they have a responsibility — we let you in, and now it’s your turn to pay it forward to help and guide the next generation.

I remember one year during promotion time, one of my mentors called me and said, this is a glorious day, congratulations, and it was great. But of course, he then said, now you have a responsibility… Now you are here, it is on you to bring the next generation along.

The reality is, somebody paved the way for him, he did it for me — and I mean clearly there are a lot of people that did so for me — but in particular, that conversation is a reminder that there is always a responsibility to lay the groundwork for the next wave, and to guide those that are coming up after you. Again, the idea of paying it forward.

It's walking into corporate America and making sure you're not the only Black female or Black person that comes into the room; you're shepherding that next generation in.

And you're also shepherding them on how to function in the room. Because you can get in a room and then get kicked out...

So, learning how to function and operate and understand the importance of what it means to be in that room, and what it means for the next generation that's going to come after you and follow in your footsteps... when I think about legacy, that idea, that scenario — that is it for me.

And I've always said, I hope that somebody just says that I opened the door for them, and the door stayed open. And it stayed open for generations to come… that’s important to me.

Mistie: And we stand on the shoulders of giants, right?

Sandra: I’m telling you, absolutely.

Mistie: And the more that we think of that as individuals, how to be an enabler for who’s next and to stop the crab in the bucket mentality… when you are confident in what you do as an individual, you will have no problem reaching down and pulling somebody else up.

Because at the end of the day, no one can do it like you, and you're in a position to help others find themselves, find their dreams, and help them to achieve them as well.

That is also a part of your legacy; it's not what you can do for yourself, but how can you do it for yourself and then help others accomplish what they want to.

In addition to her work at Morgan Stanley, Sandra L. Richards is a published children's book author. Her award-winning book, Rice and Rocks, celebrates culture and diversity through the lens of food around the world.

Mistie Bass-Boyd is a retired basketball player who played in professionally in the WNBA and overseas for 10 years, including winning the 2014 WNBA Championship with the Phoenix Mercury. She has since transitioned to coaching and now works in corporate sports marketing.

This interview has been edited and condensed for clarity. Watch the full video on Parity's YouTube page.

Follow Parity on Instagram, LinkedIn, Twitter, Facebook, and TikTok to stay up-to-date on news surrounding elite women athletes and sports marketing.